According to reports, two of India’s first solar projects under a state program offering favorable tariffs to build 20,000 megawatts of capacity suffered delays, a ministry official said, adding developers may lose contracts if deadlines are missed.

According to reports, two of India’s first solar projects under a state program offering favorable tariffs to build 20,000 megawatts of capacity suffered delays, a ministry official said, adding developers may lose contracts if deadlines are missed.

“Two of the projects are behind schedule,” said Tarun Kapoor, who is responsible for overseeing the program as joint secretary at the Ministry of New and Renewable Energy.

Entegra Ltd. (EIL), whose majority shareholder is MW Corp Pvt., hasn’t yet begun building a 10-megawatt solar-thermal plant in Rajasthan, Kapoor said in an interview in New Delhi yesterday.

Enterprise Business Solutions was also given a two-month extension after being fined for missing an October deadline to build a 5-megawatt photovoltaic plant in Punjab, he said, adding that construction at the site has since begun.

Entegra Chairman Mukul S. Kasliwal said the company faced problems raising financing for its 2 billion rupee ($38 million) development because of “unreasonable” government restrictions on using a so-called special-purpose vehicle for the project. The company expects to resolve the issue and complete the plant by its 2013 deadline, he said, declining to give a timetable.

“We haven’t started because we’re not going to do something that doesn’t make sense financially,” Kasliwal said in a phone interview today. “Had we been allowed to function as an SPV, then we would’ve finished financing long ago.”

The bar on the vehicles, which allow companies to isolate risks from funding large projects, means Entegra is limited to raising smaller loans backed by its balance sheet, he said.

The company, which at the same time is building a 400- megawatt hydropower plant in Madhya Pradesh state, has already invested 100 million rupees in the solar project and is in talks over alternative funding, Kasliwal said, declining to elaborate.

Neither Kapoor nor A.K. Maggu, general manager of state-run power trader NTPC Vidyut Vyapar Nigam Ltd., was able to provide contact details for Enterprise Business Solutions. The trader signed power contracts with the developers. Bloomberg was unable to find a website or contact for EBS in an Internet search.

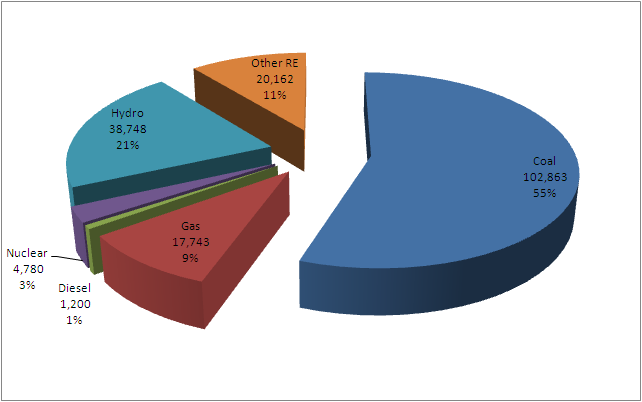

Both projects are part of the “migration” program to build a first round of plants under the national Solar Mission and boost solar capacity by the equivalent of about 18 nuclear power plants by 2022. Under the migration plan, projects get deals to sell power for as much as 17.91 rupees a kilowatt-hour. That’s about four times the average wholesale fee for coal power and above the average 12.16 rupees for more than 600 megawatts of projects awarded in India’s first solar auction last year.

Developers will lose their preferential tariffs if they fail to complete their projects on time, Kapoor said.

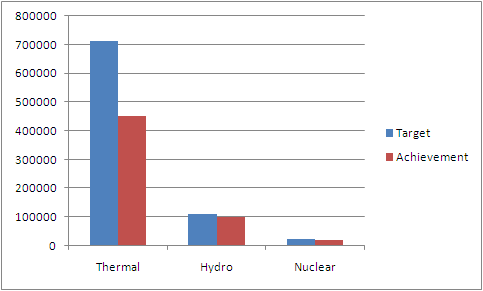

The central government plans to award more solar permits next year to meet its target of adding at least 3,000 megawatts of capacity in the five years from 2013, he said. Officials at the finance, power and renewable energy ministries are in talks over how much capacity should be auctioned in 2012, Kapoor said. “In a few months, we should have a clear picture,” he said.

Read More...