In an effort to encourage its customers in Mumbai to cut peak-hour electricity consumption, Tata Power Co. Ltd plans to share with users the savings that will result from having to purchase less power from the open market to meet demand. India’s largest integrated private power company is yet to work out a way of sharing the savings.

In an effort to encourage its customers in Mumbai to cut peak-hour electricity consumption, Tata Power Co. Ltd plans to share with users the savings that will result from having to purchase less power from the open market to meet demand. India’s largest integrated private power company is yet to work out a way of sharing the savings.

“Sharing savings is a widely used concept in the Western countries, especially in the US,” said S. Padmanabhan, Tata Power’s director of operations. “If we are buying expensive power at `8 per unit to meet a customers’ peak-hour demand, and his tariff is `5 per unit, and if he doesn’t consume that unit during peak hours, then I, as a utility, don’t have to buy that unit of power. So it brings savings to both me and him. In this case, the saving will be of `3 per unit. This saving can be shared based on a predetermined formula.”

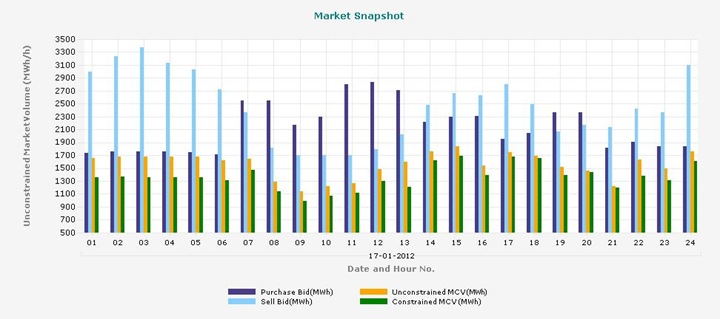

Tata Power caters to one-third of Mumbai’s total demand, which is 2,400-2,500 megawatts at present and goes up to 3,000-3,100 megawatts during summers. The remaining demand is met by the Brihanmumbai Electricity Supply and Transport Undertaking (BEST) and Reliance Infrastructure Ltd. While BEST supplies power between Colaba and Nariman Point in south Mumbai, and Sion and Mahim in north Mumbai, Reliance supplies power to suburbs.

Power distribution utilities buy expensive power through short-term contracts to meet peak-hour demand. Typically, contracted power costs `2.5-4 per unit. Buying power in the spot market or through short-term contracts can cost anything between `5 and `11 per unit, depending on the season.

Tata Power’s customer base in Mumbai grew from around 22,000 in 2008 to over 250,000 by the end of 2011. Its power generation capacity for Mumbai is around 1,800 megawatts. During the winter season it purchases about 70-100 megawatts from the open market at the average rate of around `5 per unit. It also supplies power in Delhi through its subsidiary North Delhi Power Ltd. Power generated from Tata Power’s own generation capacity costs around `3.70 per unit. The demand can shoot up to 150 megawatts during summers, and so do the rates.

If supply does not match demand even after the purchase of the expensive power, utilities resort to load shedding. But since Mumbai is the only city in India to have 24x7 electricity supply, this option is not available to utilities like Tata Power.

Padmanabhan said the proposed sharing of cost savings is part of the company’s plan to implement several demand-side management programmes to reduce peak-hour consumption, which will help the company improve its profitability.

”Over the next five years, we expect (Mumbai’s power) demand will grow beyond 4,000 megawatts and our company is aiming to have a 50% market share of the total power supplied in Mumbai,” said Padmanabhan. The company is planning to invest `250 crore annually over the next four to five years to enhance its network. Currently, it is using Reliance Infrastructure’s network.

“To introduce such a (savings sharing) scheme, Tata Power will have to put in place information technology infrastructure to monitor the pattern of energy consumption of its customers,” says Ashwini Chitnis of Pune-based think tank Prayas Energy Group, which does research on issues and policies related to the energy sector.

Added Kameswara Rao, executive director and head of the infrastructure, utility and mining practice at consultancy firm PriceWaterhouseCoopers India Pvt. Ltd, “Such saving schemes can be implemented only for industrial and commercial consumers who are charged much higher tariff than average cost of power supply whereas residential and other consumers are subsidized by these industrial and commercial consumers.”

The 25 MW Solar Photovoltaic (PV) Project of Visual Percept Solar Project (VPSPPL), a subsidiary of Talma Chemical Industries (Bhanshali family promoted company) in Gujarat has been commissioned today.

The 25 MW Solar Photovoltaic (PV) Project of Visual Percept Solar Project (VPSPPL), a subsidiary of Talma Chemical Industries (Bhanshali family promoted company) in Gujarat has been commissioned today.